Note: The following information relates to the provisions of the 1135 waiver during the Coronavirus (COVID-19) Public Health Emergency (PHE) which went into effect on March 6, 2020.

Updated: May 18, 2020

Telemedicine during the COVID-19 emergency

In this article, telemedicine services during the COVID-19 public health emergency (PHE) are divided into the following three categories, to conform with the terminology in the March 30, 2020 Interim Final Rule from CMS:

- Telehealth Visits: Refers to services traditionally provided in face-to-face clinical settings, e.g., physician’s office, hospital inpatient, emergency department, outpatient clinics etc., but recently been approved by CMS to be conducted remotely. These services traditionally required audio and video real time, interactive communication. However, during the COVID-19 PHE, a select number of these services may be conducted by telephone (or similar audio-only) communication. Consequently, the CPT/HCPCS codes for these services, when provided via telehealth technology, are identical to that provided in face-to-face settings. The total number of CPT/HCPCS codes eligible for telehealth technology, has been greatly expanded by the CMS during the PHE. Telehealth visits are paid at the same rate as in-person visits for the duration of the PHE.

- Telephone-Only Evaluation and Management or, Assessment and Management, Services: These codes previously had a non-covered status by CMS but are now billable during the PHE. Two sets of codes for time-based telephone services are reportable, for practitioners who report E/M services, and for other qualified health professionals (QHPs) who do not report E/M services, respectively.

- Communication Technology-Based Services: This category includes two groups of services which must be initiated by the patient:

→ The online digital inquiry/visit (E-Visit), entails evaluation, assessment, and/or management of the patient by the physician or other QHP. Two sets of codes for time-based E-Visits are reportable, for practitioners who report E/M services, and for other QHPs who do not report E/M services, respectively.

→ “Virtual check-ins” are brief technology-based services for patients to communicate with their providers remotely, using either audio-only communication or remote evaluation of images and recorded videos sent by patients. The purpose of “virtual check-ins” is to determine whether an office visit or other service is needed.

I. TELEHEALTH VISITS:

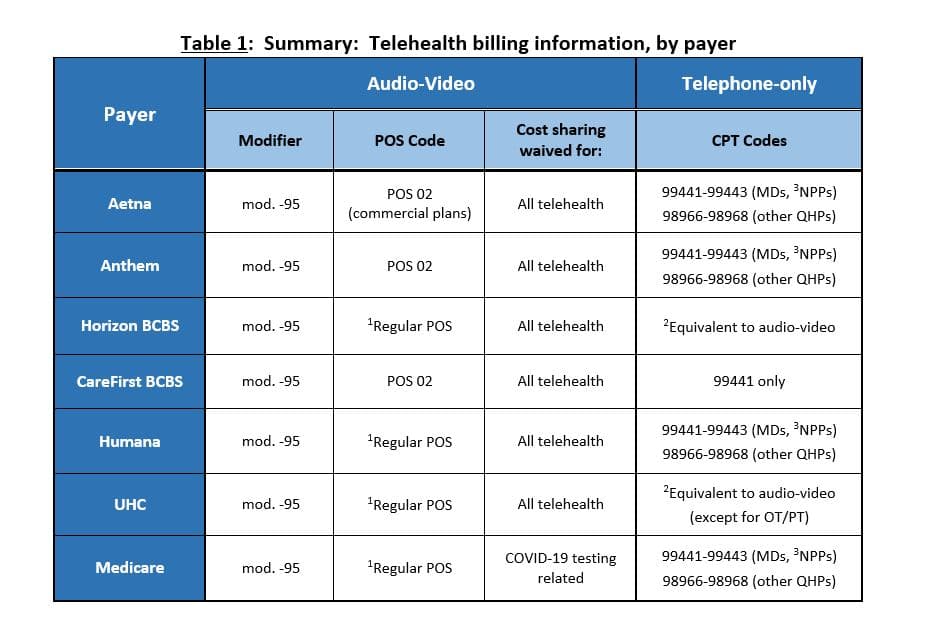

Use of interactive audio and video telecommunications system that permits real-time communication between the physician or other QHP and the patient at a remote site. Telehealth visits take the place of in-person services at the provider’s office, nursing facility or hospital (summarized in Table 1).

- Patients: For new or established patients at any location (including place of residence).

- Practitioners: Practitioners include physicians, nurse practitioners, clinical nurse specialists, physician assistants, clinical psychologists, clinical social workers, physical therapists, occupational therapists, speech language pathologists and registered dietitian nutritionists.

- Medical coding and billing for telehealth visits:

A) Which procedure codes? The following is a partial list of telehealth-eligible services:- Office or outpatient E/M for new/established patient: 99201-99205, 99211-99215

- Observation E/M, initial/subsequent: 99217-99220, 99224-99226, 99234-99236

- Hospital inpatient E/M, initial/subsequent: 99221-99223, 99231-99233

- Psychotherapy, diagnostic interview: 90832-90834, 90836-90838, 90791- 90792

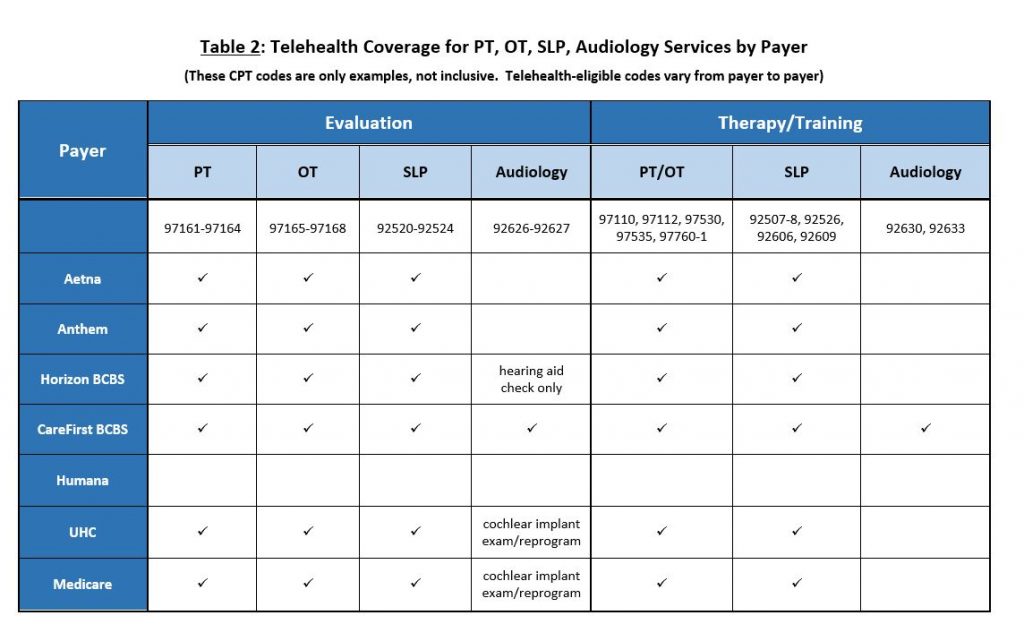

- Physical therapy (PT) and evaluation: 97161- 97164, 97110, 97112, 97116,

- Occupational therapy (OT) and evaluation: 97165-97166, 97167-97168, 97110, 97112, 97116

- Speech-language pathology (SLP): 92507-92508, 92521-92524

(See Table 2 for summary of telehealth coverage for PT, OT and SLP services).

CMS has expanded the list of allowable telehealth codes during the PHE, which can be found at:

https://codingintel.com/mp-files/cheat-sheet_covered-telehealth-services-for-phe_covid-19.pdf/

or: https://www.cms.gov/Medicare/Medicare-General-Information/Telehealth/Telehealth-Codes

B) During the PHE, selected telehealth services may be furnished via audio-only communication, including behavioral health assessment and intervention, speech therapy, alcohol/substance intervention, tobacco use counseling. Refer to the above list of allowable telehealth codes.

C) POS: For Medicare billing, use the place of service (POS) code that would be normally used for an in-person visit. This applies to all telehealth services, including PT, OT, SLP and behavioral health. For commercial insurance, the POS code for telehealth services varies among payers (see Table 1)

D) Reimbursement: Telehealth visits are paid at the same rate as regular, in-person visits. Patients should be notified that these visits will be billed the same and out-of-pocket costs may apply.

E) Waiver of cost-sharing: Medicare (and private payers including Anthem BCBS, Horizon BCBS, Humana, Cigna, Aetna, Cigna and UHC), is waiving and will cover cost-sharing for COVID-19 diagnostic tests and visits related to COVID-19 testing (i.e., visits resulting in the order or administration of a COVID-19 test, or evaluation of a patient to determine the need for such a test).

Providers may voluntarily waive cost-sharing for non-COVID-19-related telehealth and virtual/digital services. Although Medicare is not covering cost-sharing for visits that are not COVID-19-related, many commercial payers are covering the cost sharing for all telehealth visits (see Table 5.

F) Modifiers:

- Modifier -95 is used to indicate telehealth services.

- For PT, OT and SLP telehealth services: Use modifier -95, in addition to appropriate service-related modifier (i.e., modifier -GP for PT, modifier -GO for OT and modifier -GN for SLP).

- If the visit resulted in administration of the COVID-19 test, or the patient was evaluated to determine the need for such testing, Medicare requires an additional modifier -CS to reimburse 100% of the allowable cost for the service.

1Regular POS: Same POS code that would be reported if the visit had been conducted in-person.

2If patients have no access to video system, audio-only services will be reimbursed as telehealth.

3NPPs: Non-physician practitioners who report E/M services (including: physician assistants, nurse practitioners).

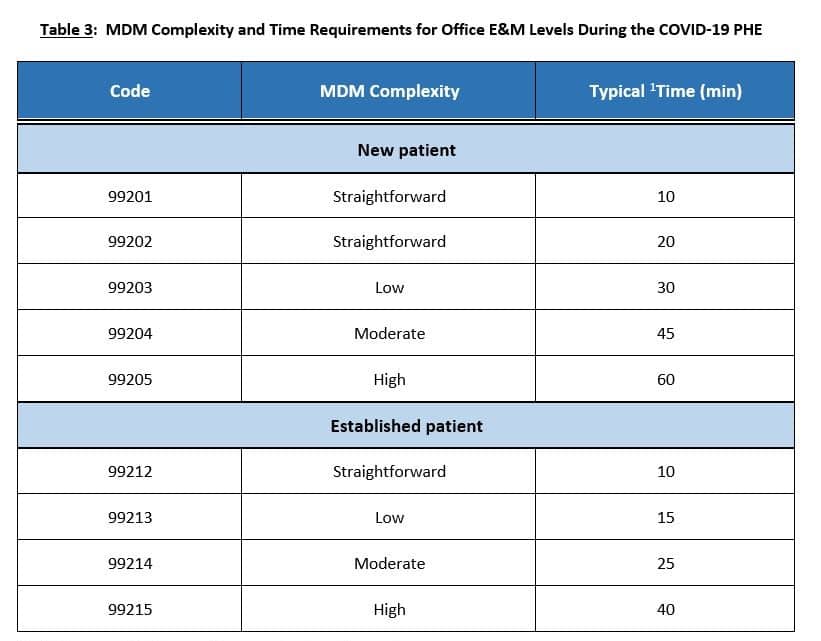

4. E/M level determination: During the PHE, the E/M level is determined based on either the MDM complexity alone or the time alone. Time is defined as total time spent by the practitioner on the day of encounter (including face-to-face and non-face-to-face time). See Table 3 for the MDM complexity and times associated with the E/M levels. During the PHE, the history or examination elements will not be used to determine the E/M level. In addition, requirements pertaining to counseling and/or care coordination for time-based codes, will be waived. If time is used to determine the E/M level, the time of service must be documented in the note.

5. Documentation:

- Indicate that the visit is conducted via telehealth;

- Names of all participants (including patient’s family members if they are assisting);

- Location of provider and patient;

- Notate patient’s consent for telehealth (at least on an annual basis; verbal consent is acceptable);

- For time-based codes, document either start/stop times or total time;

- History and physical exam documentation requirements are waived during the PHE.

1Total time spent by the practitioner on the day of encounter

II. TELEPHONE ONLY SERVICES:

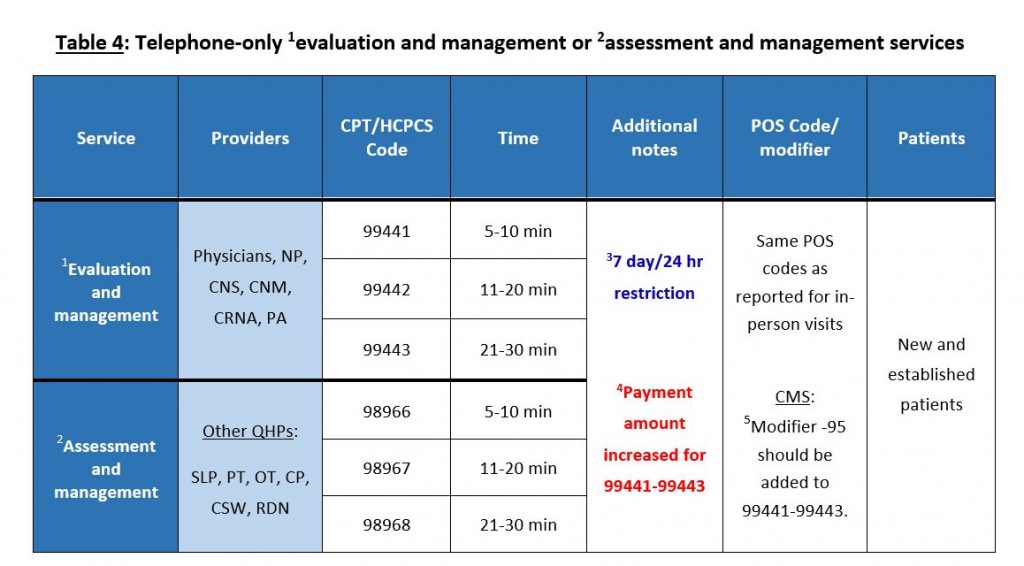

Evaluation and management or, assessment and management services by telephone communication (summarized in Table 4).

- Patients: For new or established patients at any location (including place of residence).

- These services include the diagnosis and management of a problem over the phone.

- Evaluation and management: Practitioners who may independently bill for E/M visits (i.e., physicians, nurse practitioners, clinical nurse specialists, physician assistants), may bill the following codes:

- 99441: 5 to 10 minutes of medical discussion;

- 99442: 11 to 20 minutes of medical discussion;

- 99443: 21 to 30 minutes of medical discussion;

- Assessment and management: Qualified health care professionals who do not independently bill for E/M visits (i.e., physical therapists, occupational therapists, speech language pathologists, clinical psychologists, registered dietitian nutritionists), may bill the following codes:

- 98966: 5 to 10 minutes of medical discussion;

- 98967: 11 to 20 minutes of medical discussion;

- 98968: 21 to 30 minutes of medical discussion;

- The time spent should be documented in the note.

- These codes are also not reported if the telephone call is in reference to a service reported by the provider that occurred within the past seven days or within the postoperative period of a previously completed procedure. In addition, do not report these codes if the telephone service results in a decision to see the patient within 24 hours.

- POS: Use the place of service code that would be normally used for an in-person visit.

- Modifiers: Since 99441-99443 have been officially added to the CMS telehealth list, one MAC has directed that modifier -95 should be added to these codes. It is unclear if modifier -95 should be added to 98966-98968.

- Retroactive to March 1, 2020, payments for services billed with 99441-99443, have been increased. The relative value units and payment amounts will align as follows: 99441 will align with 99212, 99442 will align with 99213, and 99443 will align with 99214.

1 For practitioners who may report E/M services, e.g., physicians, nurse practitioners (NP), clinical nurse specialists (CNS), certified nurse midwives (CNM), certified registered nurse anesthetist (CRNA) and physician assistants (PA).

2 For practitioners who do not report E/M services, e.g., speech-language pathologists (SLP), physical therapists (PT), occupational therapists (OT), clinical psychologists (CP), clinical social workers (CSW), registered dietitian nutritionists (RDN).

3 These codes are not reported if the provider performed a related (e.g., E/M or therapy) service within the previous seven days or if the call is initiated within a postoperative period. Also, do not report if the telephone call results in a decision to see the patient within 24 hours or by the next available urgent visit appointment.

4 Retroactive to March 1, 2020, CMS has increased payments for 99441-99443 from a range of approximately $14-$41 to approximately $46-$110 (99441 will align with 99212, 99442 will align with 99213, and 99443 will align with 99214).

5 Based on directions from one MAC. It is unclear if the same applies to 98966-98968.

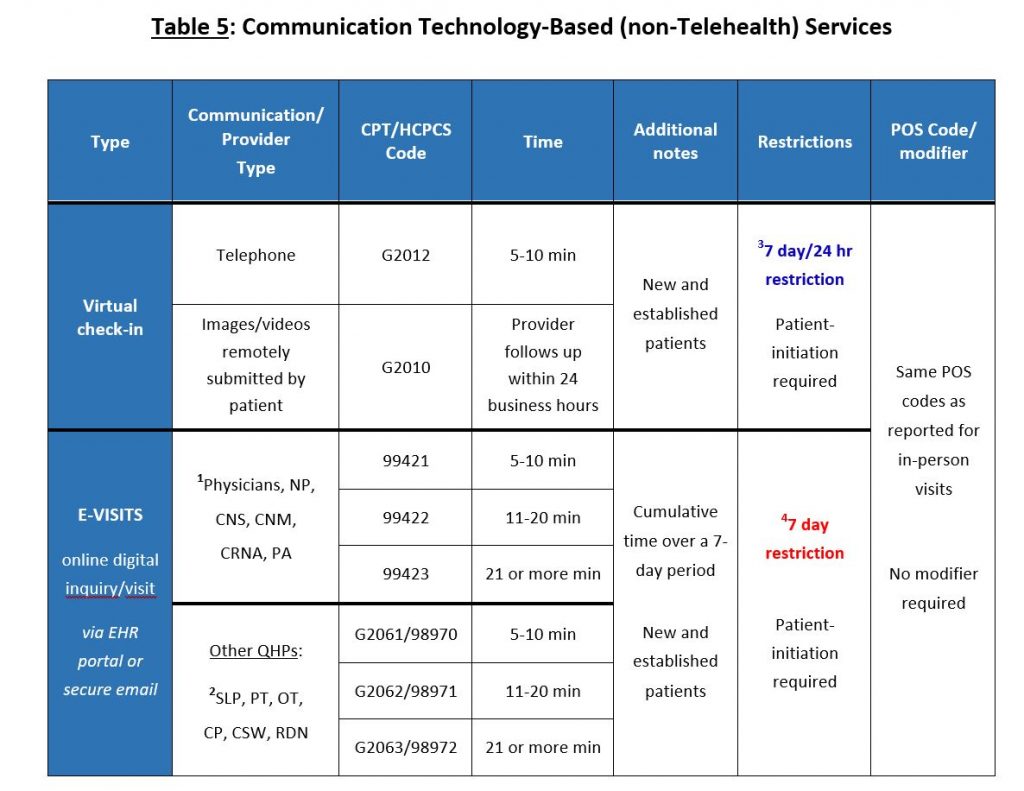

III. COMMUNICATION TECHNOLOGY-BASED SERVICES (summarized in Table 5):

Virtual Check-Ins:

Patient-initiated brief communication (e.g., to determine if the patient needs to be seen in-person) with physicians or non-physician practitioners, via telephonic or electronic means, to determine whether an office visit or other service is needed.

- Patients: For new or established patients at any location (including place of residence).

- Practitioners: Physicians, nurse practitioners, PAs, clinical social workers, clinical psychologists, physical therapists, occupational therapists, and speech language pathologists.

- Not separately billable if related to an E/M service provided within the previous seven days or it leads to an E/M service or procedure within the next 24 hours.

- Codes:

- HCPCS code G2012: The provider spends 5 to 10 minutes by audio-only (telephone or other synchronous audio) interaction with a patient.

- HCPCS code G2010: The provider receives recorded video and/or images remotely from a patient, evaluates the data, interprets the findings, and follows up with the patient within 24 business hours (via phone, email, text messaging, etc., either real-time or asynchronous).

- The time spent should be documented in the note.

- POS: Use the place of service code that would be normally used for an in-person visit. No modifiers required.

E-Visits (online digital inquiry/visit):

Patient-initiated online digital communication with physicians or other qualified health care professionals (QHPs).

- Communication via online patient portals or secure email. Provider responds to the patient’s health concerns, answers any medical questions, and recommends management.

- Patients: For new or established patients at any location (including place of residence).

- Practitioners who may independently bill for E/M visits (i.e., physicians, nurse practitioners, clinical nurse specialists, physician assistants), may bill the following codes. (The times below represent cumulative time spent in communication with the patient over a 7-day period):

- 99421: 5 to 10 minutes of cumulative time;

- 99422: 11 to 20 minutes of cumulative time;

- 99423: 21 or more minutes of cumulative time.

- QHPs who do not independently bill for E/M visits (i.e., physical therapists, occupational therapists, speech language pathologists, clinical psychologists), may bill the following codes. (The times below represent cumulative time spent in communication with the patient over a 7-day period):

- G2061 (Medicare) / 98970 (Commercial): 5 to 10 minutes of cumulative time;

- G2062 (Medicare) / 98971 (Commercial): 11 to 20 minutes of cumulative time;

- G2063 (Medicare) / 98972 (Commercial): 21 or more minutes of cumulative time.

- POS: Use the place of service code that would be normally used for an in-person visit. No modifiers required.

- Additional time-related requirements for E-Visits:

- The seven-day period begins with the physician or other QHP’s initial, personal review of the patient inquiry. The time spent should be documented in the note. The documented time would include reviewing the patient’s inquiry, the patient’s record and data relevant to the assessment, interacting with clinical staff about the patient’s problem, developing management plans, and ordering tests and prescriptions.

- If the patient initiates an E-Visit within seven days of a previous E/M service, and both services relate to the same problem, the E-Visit is not reported.

- If an E/M visit occurs within seven days after the initiation of the E-Visit, the work devoted to the

E-Visit is incorporated into the reported E/M visit (e.g., additive of visit time for a time-based E/M visit or additive of decision-making complexity for a key component-based E/M visit). The E-Visit is not reported separately.

1Practitioners who may report E/M services.

2Practitioners do not report E/M services.

37 day/24 hr restriction: Virtual check-ins are not separately billable if related to an E/M service provided within the previous seven days or if they lead to an E/M service or procedure within the next 24 hours or soonest available appointment;.

47 day restriction: E-Visits are not separately billable if related to an E/M service that occurred within the previous seven days or within the global period following a procedure. If an E/M visit occurs within seven days after the initiation of the E-Visit, the E-Visit is used to determine the level of the reported E/M visit, but is not separately reportable.

Information from CMS about telemedicine during the COVID-19 PHE can be found at:

- https://www.cms.gov/newsroom/press-releases/trump-administration-issues-second-round-sweeping-changes-support-us-healthcare-system-during-covid

Additional regulatory waivers and rule changes, including expanded telehealth services; 4/30/2020) - https://www.cms.gov/files/document/covid-final-ifc.pdf

(Policy and Regulatory Revisions in Response to the COVID-19 Public Health Emergency, Interim final rule; 03/26/2020) - https://www.cms.gov/newsroom/fact-sheets/medicare-telemedicine-health-care-provider-fact-sheet

(Medicare Telemedicine Health Care Provider Fact Sheet; 3/17/2020) - https://www.cms.gov/files/document/03092020-covid-19-faqs-508.pdf

(COVID-19 Frequently Asked Questions (FAQs) on Medicare Fee-for-Service Billing; updated 4/17/2020)

General telehealth (non-COVID-19 related) information from Medicare can be found at:

Additional telemedicine coding & billing resources (COVID-19 PHE-related):

- https://www.aafp.org/pubs/fpm/blogs/gettingpaid/entry/coronavirus_diagnosis_coding.html

(COVID-19: Practice Management, from the American Academy of Family Physicians) - https://www.aafp.org/pubs/fpm/blogs/gettingpaid/entry/coronavirus_diagnosis_coding.html

(Telehealth Coding Scenarios, from the American Academy of Family Physicians) - https://codingintel.com/telemedicine-and-covid-19-faq/

(Telemedicine and COVID-19 FAQ, from CodingIntel) - https://www.acponline.org/practice-resources/covid-19-practice-management-resources/covid-19-telehealth-coding-and-billing-information

(Telehealth Coding and Billing During COVID-19, from the American College of Physicians). - https://www.ama-assn.org/system/files/2020-03/covid-19-coding-advice.pdf

(Special coding advice during COVID-19 public health emergency, American Medical Association) - https://www.aafp.org/journals/fpm/explore/online/virtual_visits.html

(Operationalizing Virtual Visits During a Public Health Pandemic, from the American Academy of Family Physicians)

PT, OT, SLP/audiology telemedicine coding & billing information (COVID-19 PHE-related):

- http://www.apta.org/PTinMotion/News/2020/4/30/CMSOpensTelehealth/

(CMS Guidance Allows PTs in Private Practice to Provide Services Via Telehealth, American Physical Therapy Association; 4/30/2020) (Billing Telehealth Services to Medicare, American Occupational Therapy Association; 5/5/2020) - https://www.asha.org/Practice/reimbursement/medicare/Providing-Telehealth-Services-Under-Medicare-During-the-COVID-19-Pandemic/

(Providing Telehealth Services Under Medicare During the COVID-19 Pandemic, American Speech-Language-Hearing Association; 5/1/2020)

Resources for COVID-19 testing CPT codes and COVID-19 diagnosis ICD-10-CM codes:

- https://www.ama-assn.org/practice-management/cpt/covid-19-coding-and-guidance

COVID-19 coding and guidance, American Medical Association) - https://www.ama-assn.org/system/files/2020-04/cpt-assistant-guide-coronavirus-april-2020.pdf

(CPT Assistant, SARS-CoV-2 Serologic Laboratory Testing, American Medical Association)(Coding for COVID-19 and Non-Direct Care, American Academy of Pediatrics) - https://www.codingclinicadvisor.com/faqs-icd-10-cm-coding-covid-19

Frequently Asked Questions Regarding ICD-10-CM Coding of COVID-19, American Hospital Association)

Private payer telehealth billing and coding policy documents:

- https://individual.carefirst.com/individuals-families/about-us/coronavirus-telemedicine.page

https://individual.carefirst.com/carefirst-resources/pdf/carefirst-telemedicine-code-modifier.pdf

Telemedicine Guidelines, CareFirst of Maryland, Inc. - https://www.aetna.com/health-care-professionals/provider-education-manuals/covid-faq/telemedicine.htmll

COVID-19: Telemedicine FAQs; Aetna - https://providernews.empireblue.com/article/information-from-empire-for-care-providers-about-covid-19-updated-april-22-2020

https://providernews.anthem.com/georgia/article/information-from-anthem-for-care-providers-about-covid-19-4

Information from Empire (Anthem) for Care Providers about COVID-19 - https://www.humana.com/provider/coronavirus/telemedicine

https://docushare-web.apps.cf.humana.com/Marketing/docushare-app?file=3923140

Telehealth – Expanding access to care, Humana - https://www.horizonblue.com/providers/policies-procedures/policies/reimbursement-policies-guidelines/telemedicine-services/telemedicine-services-reimbursement-policy-temporary-addendum-horizon-bcbsnj-commercial-aso-plans

Telemedicine Services Reimbursement Policy: Temporary Addendum for Horizon BCBSNJ Commercial/ASO plans and products - https://static.cigna.com/assets/chcp/resourceLibrary/medicalResourcesList/medicalDoingBusinessWithCigna/medicalDbwcCOVID-19.html

Cigna’s response to COVID-19 - https://www.uhcprovider.com/en/resource-library/news/Novel-Coronavirus-COVID-19/covid19-telehealth-services/covid19-telehealth-services-telehealth.html

COVID-19 Telehealth, United HealthCare