The unprecedented COVID-19 pandemic has upturned the healthcare industry, and providers around the world have been racing to keep up with the challenges of this new normal in healthcare. While many challenges persist, providers are set on turning their attention towards making their practices more efficient and delivering the best patient care in the most efficient and convenient way possible.

KLAS Research and Bain & Company partnered together and released their 2022 Healthcare Provider IT Report, where their research showed that nearly 45% of providers claim that their spending on software increased over the past 12 months. Research also indicated that 95% of providers expect to make new software investments within the next 12 months.

What’s driving spending? Nearly 80% of providers cited labor shortages, inflation concerns, or specific organizational situations such as changes in leadership, as the main driver for rising new investments. Factors such as labor shortages caused by COVID-19, and burnout amongst physicians, nurses, and IT office personnel, continue to plague the healthcare industry.

The research also concluded that healthcare IT is among the top 3 priorities for almost 40% of providers, and a top 5 priority for nearly 80% of providers. Patient data is amongst the most sought-after data to hackers, making practices and hospitals a shiny red target. In 2021, 66% of healthcare organizations were struck by ransomware; this is almost double the number from the year before. Of these 66%, 61% will go on to pay the ransom. Unfortunately, 80% of providers that pay the ransom are subject to a second attack.

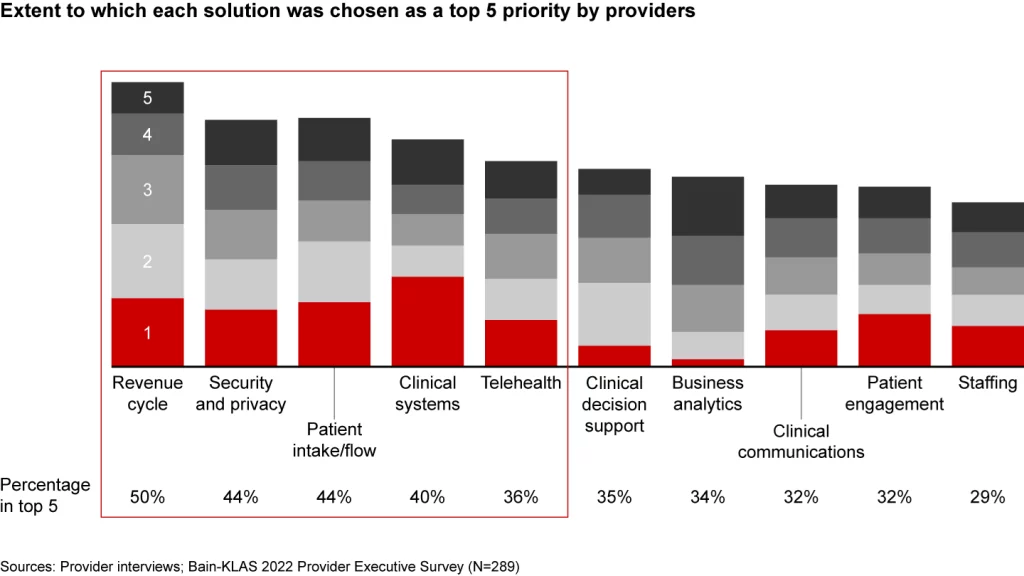

Top provider investment priorities over the next 12 months

Cost inflation and rising wages continue to push providers into looking into software solutions that boost productivity and automation, with the intent of stronger financial outcomes and higher-quality patient care.

1. Revenue cycle management software has become a top priority for all providers, this especially for true for smaller provider organizations that have to navigate complex payer landscapes. RCM software continues to enhance its system with AI and the agility to process complex claims.

2. Security and privacy software is the second top investment priority for providers over the next year, which is driven by increased risk of data breaches due to increase of technology implementation. Hackers do not discriminate against smaller practices and groups, in fact, they know that their IT systems may not be the best, making them an easy target. Data breaches are not cheap either, and are triple the cost of a data breach compared to other industries. On average, healthcare institutions pay approximately $500 per stolen record. A data breach is detrimental to the trust, reputation, and credibility of a practice, which is why it has become such a high priority in a short amount of time.

3. Patient intake/flow software is the third investment priority amongst providers, caused by the high volume of patients due to the pandemic. Automation is playing a critical role in reducing administrative burden and improving patient satisfaction. Healthcare is shifting to a consumer-oriented model, and providers are taking strides in streamlining the intake processes in their practices, which can both speed up cash collections and provide more seamless patient experience.

4. Clinical systems remain a top priority for investment. Many providers have EHR systems, but many are planning to focus on streamlining workflows and boosting their productivity.

5. Telehealth was essential to many providers in the beginning of the pandemic, and while interest has declined, it still remains one of the top priorities for providers. Behavioral health providers are amongst those who benefit the most from telehealth. Telehealth platforms, especially those that integrate with EMR systems, are an opportunity for providers to expand their offerings and increase their clientele.

More than 50% providers are struggling with the flood of offerings in the market, according to research. They cite concerns about missing high-impact new solutions and feeling overwhelmed by the number of offerings to evaluate. If you’re feeling overwhelmed by all the solutions and new offerings glutting the healthcare market, let Microwize help you evaluate your practice’s workflows and make recommendations based on your specific goals, schedule a consultation today!